5 Easy Facts About chapter 13 bankruptcy Described

You pay the money to your trustee they usually distribute payments for your creditors. Your creditors aren’t permitted to Call you for additional funds. The truth is, you’re essentially confident you received’t talk with a creditor or collector for the whole time it's going to take to complete your payment timetable.

This stops creditors from getting any action in opposition to you to gather on the debts — typically, they’re even prevented from contacting you any longer, so no a lot more collector calls. All lawsuits and wage garnishments are stopped, as well.

I do not mind if I in no way speak with my attorney given that the attorney oversees the filing and the price is less costly

Neither Skilled nor immediate lawful services is furnished on this site. Lawinfopedia.com must only be utilised as a resource for lawful difficulty-relevant info but not a substitute for Specialist attorneys or lawful corporations.

Several Web-sites use cookies or comparable instruments to shop info on your browser or product. We use cookies on BBB Web sites to keep in mind your preferences, increase website functionality and greatly enhance consumer practical experience, and to endorse written content we believe will be most appropriate to you personally.

Nolo was born in 1971 to be a publisher of self-enable authorized publications. Guided from the motto “regulation for all,” our attorney authors and editors are outlining the legislation to daily individuals at any time due to the fact. Find out more about our background and our editorial requirements.

Bankrate.com is undoubtedly an unbiased, promoting-supported publisher and comparison service. We're compensated in exchange for placement of sponsored services and products, or by you clicking on sure backlinks posted on our internet site. For that reason, this payment may well effects how, where As well as in what order products look within just listing types, except in which prohibited by law for our home loan, household fairness and also other dwelling lending goods. Other variables, such as our personal proprietary Web page rules and regardless of whether an item is obtainable close to you or at your self-selected credit rating rating vary, can also affect how and where by items look on This page. While we strive to read what he said provide an array of delivers, Bankrate would not include information about each economic or credit rating goods and services.

Because some dates overlap, you'll be wanting to consult with the attorney for particulars or study more details on how to file for Chapter thirteen bankruptcy.

You are able to’t discharge all debts by bankruptcy. You'll find specified forms of debt which might be “dischargeable” and Some others which can be “nondischargeable.” A proficient bankruptcy law firm can overview your debt and enable you to have an understanding of which varieties of financial debt you're handling.

Your financial debt is frozen. All credit card debt on unsecured claims are frozen the day you file for Chapter 13. This implies payments you make in your creditors are accustomed to Click This Link shell out down credit card debt rather than becoming eaten up by interest and late expenses.

Chapter thirteen bankruptcy, also referred to as a reorganization, is often a authorized system that lets you restructure your credit card debt being extra manageable based on your finances. With the help of an attorney, you file a petition for Chapter 13 with a bankruptcy court. Whilst you’re not necessary to seek the services of an attorney, their knowledge might assist your likelihood of accomplishment. Besides filing, you her response will post a proposal for repaying your creditors after a while.

These cookies allow for us to rely visits and site visitors sources so we can easily measure and improve the general performance of our internet site. They help us to grasp which web pages are essentially the most and the very least common and see how you could try here readers transfer around the web-site.

In order to qualify for Chapter 13 bankruptcy, you need to establish which you could meet up with the economic obligations of constructing payments with your personal debt. Chapter thirteen supplies you some Regulate within the payment plan and presents a second chance for trying to keep your property, paying out off your taxes, and retaining your vehicle.

Declaring bankruptcy might be a fresh begin for a fantastic read anyone in dire fiscal straits. Although not all bankruptcies are the exact same. In this article, we are going to evaluate Chapter 13, or wage earner's bankruptcy, a decide to repay debts in the structured way when preserving belongings.

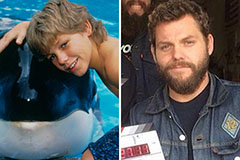

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!